Moving Average Strategy

Let's delve into the application of moving averages in our trading. When observing a price chart alongside a moving average line, we encounter two distinct signals: a tendency reversal occurs when the price crosses the moving average level, and a tendency continuation happens when the price rebounds off this level, treating the indicator as support or resistance depending on its position relative to the price. To effectively capture these signals, it's crucial to use a moving average with a substantial period. Importantly, each trading instrument requires an individually tailored period selection. Let's examine the performance of a moving average with a period of 30 on the USDCAD chart.

Here's the procedure for moving average bounce trade:

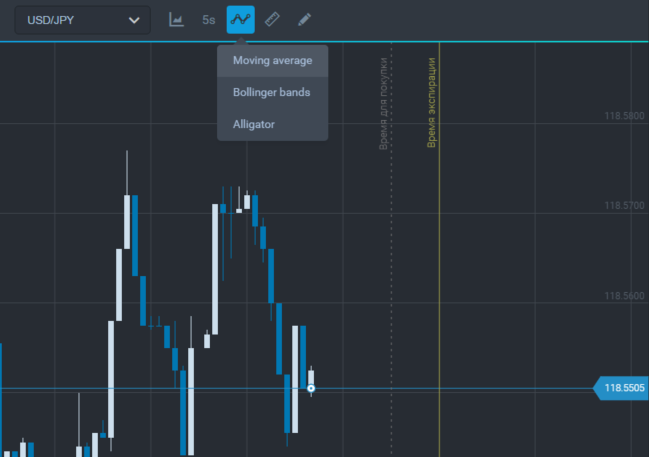

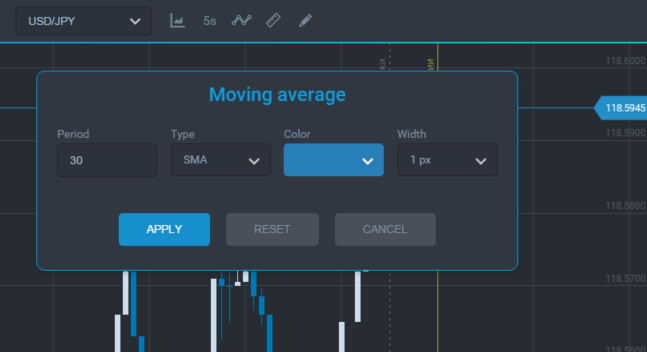

1) Add a simple moving average (SMA) with period 30.

Add an indicator

Indicator settings

2) Wait for a trading signal after the price has reached the MA line.

3) Trade online after a new candlestick has appeared and bounced off the indicator line.

Buying a call after bouncing off a moving average

Here's the procedure for moving average breakout trade:

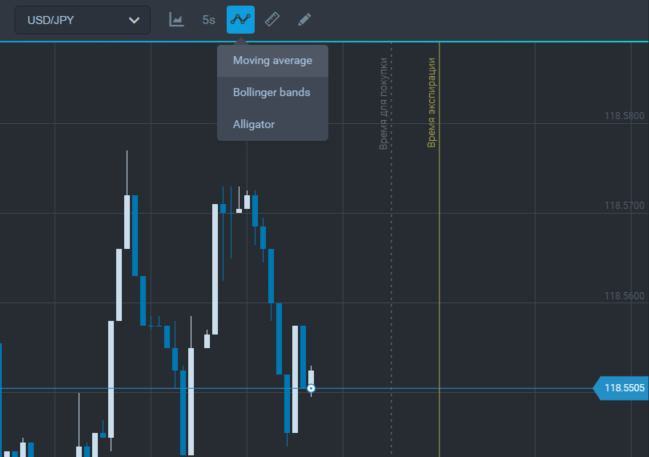

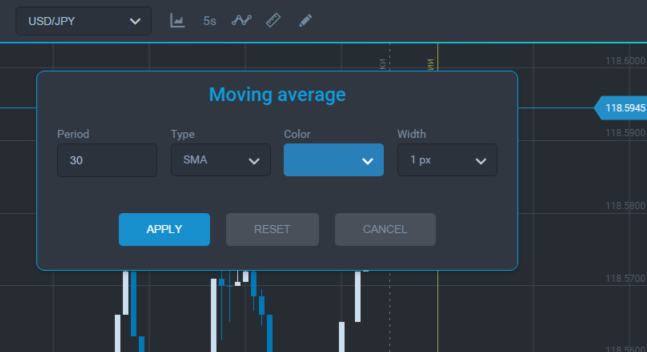

1) Add a simple moving average (SMA) with period 30.

Add an indicator

Indicator settings

2) Wait when a candlestick is closed outside the MA line.

3) Trade online in a breakout direction after a new candlestick has appeared and closed outside the moving average line.

Buying a put after a moving average breakout

The indicator is easy to use and all you need is to choose an individual period for the trading tool.